When thinking about your personal carbon footprint, you may consider your choices regarding your modes of transportation, how often you fly, or even your food intake. However, have you ever thought about how your financial choices may be impacting the environment?

The link between the climate crisis and how you spend or invest your money may not be as apparent as the other examples, and your personal finances might not even seem to be a direct emitter of CO2 emissions, but in an effort to combat climate change and reduce your carbon footprint, the choices you make with your money is actually quite important.

We trust our chosen banks to responsibly deal with our money, but what you may not know is that many banks are also well-documented financiers of climate change, and 60 of the world’s biggest banks are among them. According to a report from Rainforest Action Network and five other non-profits, these banks have provided over $3.8 trillion to fossil fuel companies since the Paris Agreement was adopted in the year 2015, with the numbers only growing more and more each year.

In order to keep the oil flowing and coal burning, oil & gas industries need huge investments to fund their exploration and infrastructure. US banks continue to be the biggest financiers of the climate crisis, with the top 4 fossil fuel funders in the world being well-known companies such as JPMorgan Chase, Citi, Wells Fargo, and Bank of America. Morgan Stanley and Goldman Sachs also join them in the top 14.

Altogether, these 6 banks provided over 29% of fossil fuel financing in 2021. Some of the major banks have made commitments to invest in green projects and renewable energy, but only a few have actually lived up to their pledges. Therefore, oil and gas funding continues to be on the rise.

Increased wildfires.

— Greenpeace UK (@GreenpeaceUK) August 9, 2022

Record breaking flooding.

Droughts and hosepipe bans.

All of the above are a result of man-made climate change. If we want to keep our planet habitable and healthy, the dominance of the fossil fuel industry must be ended.pic.twitter.com/eDDbpTfu9a

This does not automatically mean that the money you put in banks is being directly used for fossil fuel investments. For most countries, their consumer banking arms are disconnected from their investment arms, so the money you secure in your bank account is typically used for loans to other customers, like mortgages, rather than investments. However, many banks are still free to use the money sitting in your deposit accounts to invest in the biggest climate offenders.

So, how do you ensure that your banking habits are not contributing to the climate crisis?

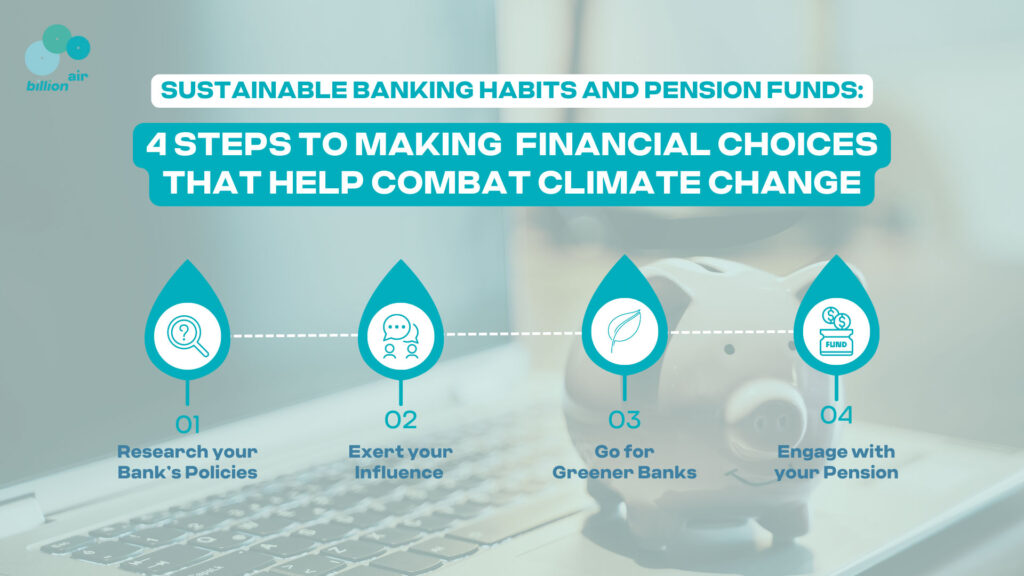

1. Research your Bank’s Policies

The report by Rainforest Action Network contains assessments of various banks’ climate policies and calls out the names of the world’s top fossil fuel funders. The report was co-authored by BankTrack, a non-profit organization that monitors and provides reports about bank finance and policies, and pushes initiatives to strengthen their commitments to climate action. Browse through BankTrack’s list of banks and learn about the climate policies of the bank you are currently dealing with.

2. Exert your Influence

Several banks have begun to make some changes in their investment strategies; however, these efforts are still insufficient. Increasing customer awareness about the links between these banks and the climate crisis will create more pressure as banks strive to keep their customers satisfied. As an individual customer, your influence matters. Capital markets campaigner and consultant, Louise Rouse, says “Banking institutions want to maintain retail bank divisions, that’s important to them. It’s also how they build brand identity, it’s how they build a social license, which gives them political power, and so on. So, individuals indicating that a bank’s climate performance is an important factor for them in their choice of the will have an impact.”

There are also organizations such as ShareAction that aim to influence these institutions from within by coordinating with shareholders at major banks to file resolutions that aim to phase out bank investments in fossil fuel projects.

3. Go for Greener Banks

If you’ve learned that your current bank’s climate values do not align with your own no matter your influence, then consider changing banks and make it clear why you’re leaving. There are several websites that help find banks that don’t finance oil and gas industries. Bank for Good offers users to search for greener banks with a broad range of services and features, and Stop the Money Pipeline campaign gives us a comprehensive guide on switching banks.

4. Engage with your Pension

Did you know that the money you leave in default funds may be partially invested in fossil fuels? Learning about your pension and how the money in it is being invested can have a big impact. “We’ve found that most people don’t even know their pension is invested,” says Michael Kind, the campaigns manager at ShareAction. “And where they do know that their pension is invested, they assume it’s invested sensibly and well.” According to the research done by ShareAction, less than 1% of assets in the world’s largest 100 pension funds were invested in low-carbon solutions in the year 2018.

Checking where your pension fund is currently investing is not always easy as the information may not be openly available, so you may need to ask for it. The good news is that the lack of transparency in pension providers is shifting. For instance, in the UK, pension funds are set to be forced by law to disclose their climate risks.

Recognize that your pension is a powerful tool for climate action, as switching from private pensions to sustainable ones gives you the assurance that your money is not being used to fund climate change, and instead is being used to invest in sustainable projects that properly align with your climate values.

Making Conscious Investments

How much do you really know about the investments you make, and how sustainable are the companies that you are investing in? Billions from pension and investment funds continue to be invested directly or by our banks into private equity firms, fossil conglomerates, and corporations that do not follow net-zero emissions. Making sure that your pension and your investments are ethically invested could be one of the most significant things you could do.

Make sure you’re making the right financial choices and Find a Financial Adviser close to you to discuss your finances.